https://ykcenter.org/wp-content/uploads/2017/01/IMG_0757.jpg

960

1280

Or Katzman

https://ykcenter.org/wp-content/uploads/2018/10/YK_center_logo-one-line.png

Or Katzman2017-01-05 18:57:312017-02-13 16:07:08Globes Panel – Impact Investment: Climate Change, Sustainable Development and Institutional Investors

https://ykcenter.org/wp-content/uploads/2017/01/IMG_0757.jpg

960

1280

Or Katzman

https://ykcenter.org/wp-content/uploads/2018/10/YK_center_logo-one-line.png

Or Katzman2017-01-05 18:57:312017-02-13 16:07:08Globes Panel – Impact Investment: Climate Change, Sustainable Development and Institutional InvestorsThe YK Call to Action

Prof. Kahane explains the YK Call to Action in this 13-minute video:

Impact Investments Needed to Save Humankind

Global economic growth in recent decades has been accompanied by the creation of immense environmental and societal risks that literally threaten the survival of humankind on planet Earth.

The 2016, Living Planet Report draws a very alarming picture about the exponential processes that are taking place around us. Just to mention a few:

- The global population consumes annually about 1.6 times the maximum global ecological resources that are available for sustainable consumption.

- The loss of species and diversity threaten the resilience of delicate food chains.

- Severe land, air & fresh water and ocean pollution.

- Considerable credible evidence is rapidly accumulating that global climate change is more severe and is accelerating faster than previously anticipated. A recent study by Prof. Hansen’s group shows drastic changes in the ocean streams that determine the climate.

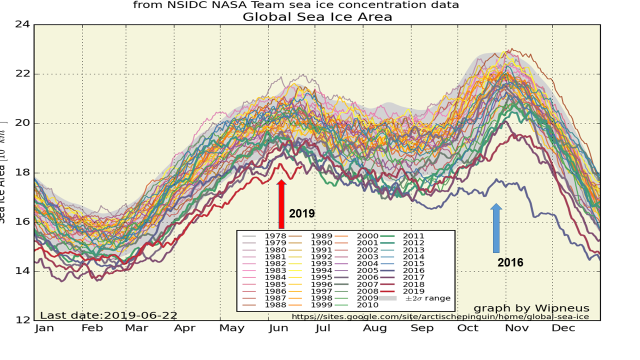

The attached graph showing the ice-covered areas in the seas until June 2019 (the red line) in comparison with that of the last 40 years. This is even below the highly exceptional 2016 figures (The Blue line). At this rate of change, in just a few years there will be no ice at the North Pole.

In addition, we face significant societal risks, including: rapid demographic changes, immigration waves, urbanization, growing income inequality and growing employment insecurity. Low interest rates (combined with higher longevity) place retirement plans at risk and create severe retirement insecurity. This risk has been augmented in the last two decades by the global trend to abolish defined benefit pension programs and replace them with a defined contribution concept—a change that has shifted the entire risk burden from the shoulders of the employers and governments to the shoulders of the individuals.

Coping with these risk on a global level requires immense investments that are estimated by the UN to be in the order of trillions of U.S. dollars per annum (8-9% of annual global GDP) for the next 15 years.

In order to mitigate these risks, there is an urgent need for the world to embrace a paradigm shift that will begin with a redefinition of relevant metrics and the development of new decision making tools for investment decisions. We advocate that we replace the current sole goal of maximization of economic values with a multi-dimensional framework that also includes Economic, Societal, Environmental and Consciousness considerations (in short ESEC). Some first steps are reflected in the recent OECD Well Being Indicators, the 2016 UN initiative of the 17 Sustainable Development Goals (SDGs) and the Multi Capital Scorecard offered by Mark McElroy (2016).

Many world leaders and executives in the private sector still ignore these risks or even deny the data and forecasts. Unfortunately, the relevant planning horizon of most political and business leaders is short (typically less than 4-5 years) and they typically think in terms of $millions or even $billions but definitely not in terms of $trillions. We are approaching quickly the point of no return, and when we get there it will become impossible to stop the catastrophe even with higher investments. Therefore, the key target is to move from $B to $T scale before 2020.

The only sources for long term financing are the public sector (governmental budgets and social security programs), and the retirement and saving plans of the private sector. The pension industry manages, on behalf of its beneficiaries (i.e., the general population), an immense portfolio of approximately $80T (where each year, about $7-10T of that is being reinvested). That was the logic behind the UN push to reach private sector signatures for the PRI (Principles for Responsible Investments) and the 2012 PSI (Principles for Sustainable Insurance) initiatives and treaties.

The attractiveness of any retirement system depends greatly on the yield on the investment portfolio. Relatively small yield differences grow over the long run into huge differences in the level of annuities that can be paid. Therefore, high yields are a necessary condition for higher savings and for enabling higher investments. The high yields create the accelerating self-propelled cycle: higher returns attract higher long term savings, and thereby larger impact investments which enable higher yields, and thereby creating more funds and higher retirement income.

Directing public money (social security) to impact investments is fairly simple, and its attractiveness can easily be affected by creating a high implicit rate of return on the social security payments. Also, the size of the social security program can easily be extended through simple changes in the conditions of the old age plans. Impact investment have potentially high yields from the public’s point of view as they have additional direct and indirect benefits – like prevention of climate changes and their consequences, avoiding large health and mortality costs due to pollution, etc. Unfortunately, the public sector still uses only economic metrics and does not analyze issues using multi-dimensional measurements that also include societal, environmental and consciousness issues, even though it is directly affected by these costs and benefits.

Directing the private insurance portfolio toward that goal is somewhat more complicated. From the private sector’s point of view, most of the societal and environmental costs and benefits are regarded as “externalities”, and are not involved in the measurements and decision making. In order to synchronize the private sector decision making with the public interests, there is a need to internalize the externalities. There are many ways to do it (in the form of taxation, subsidization, public guaranties, etc.) depending on local circumstances. Many ideas can be adopted by studying the solutions that were used a few decades ago by many countries in order to finance infra-structural projects that were needed for their economic development.

There is a need for financial innovation in order to channel the $trillions to the needed investment (mainly in infrastructure investments). It may come from within organizations, when the external costs and benefits will be internalized.

But it may also come from the crowd that is starting to put pressures on the retirement funds to invest only in impact investments and to avoid investing in projects with derogatory impact on society or the environment. There is a need to develop new financial tools that identify and support sustainable (we prefer the term “thrive-able”) growth.

We still do not have all the answers and solutions. I expect that these issues will be discussed and analyzed in the conference. We shall discuss the obstacles and the ways in which global and local insurance industries can join forces to deal with and lead the needed processes, to mitigate the environmental threats, and to lead to a healthy and thrive-able economy.

At the same time, the suggested solutions will enable the retirement industry to offer the high investment yields that are the prerequisite for any reasonable retirement arrangement. In other words, our idea is to show how we can hit two targets (mitigation of the environmental risks as well as re-establishing retirement security) with one arrow.

This is an abstract of the full document, written by Prof. Yehuda Kahane, Chairperson and Co-founder of YK Center. Prof. Kahane is a Prof. Emeritus (finance insurance and environmental studies) of Tel Aviv University, Israel. He is the recipient of the 2011 Insurance Founders Award from the Global Insurance Forum and a lifetime achievement award from the Israeli insurance industry. For the sake of simplicity, references are brought only in the full document.

YK Center is a for-benefit organization focused on closing the multi-trillion-dollar gap in funding necessary to mitigate the environmental and societal threats on humankind (for example, by achieving the 2016 United Nations Sustainable Development Goals.) To this end, YK Center empowers like-minded public and private organizations (governments, companies, NGOs, funders and civil society) to solve the two paramount challenges of our time—the environmental crisis and the long-term retirement security of people—using innovative approaches to leveraging the assets of global pension and insurance funds and revising public social security systems.