Blended Finance Could be the Key to Solving the Investment Gap

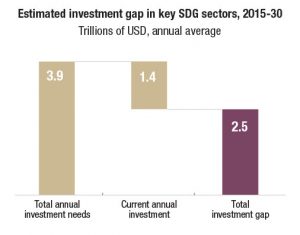

In an article written by Gavin E.R. Wilson, CEO of IFC Asset Management Company and published as part of the Sustainable Development global agenda of the World Economic Forum, the suggested approach to closing the $2.5 trillion funding gap for the SDG’s was blended finance.

Blended finance is the strategic use of development finance and philanthropic funds to mobilize private capital flows to emerging and frontier markets, resulting in positive results for both investors and communities. It offers the possibility to scale up commercial financing for developing countries and to channel such financing toward investments with development impact.

Blended finance contributes to development objectives by:

- Increasing capital leverage: Extends the reach of limited development finance and philanthropic funds as they are used strategically to facilitate larger volumes of private capital that are channeled to investments with high development impact.

- Enhancing impact: The skill sets, knowledge, and resources of public and private investors can increase the scope, range, and effectiveness of development-related investments.

- Deliver risk-adjusted returns: Risk can be managed to realize returns in line with market expectations.

By design, blended finance is a way to establish multi-stakeholder platforms around specific issues. An important emerging lesson is that blended finance transactions often bring together a broad coalition of stakeholders around a particular issue, including multilateral development agencies, private commercial investors, and impact investors.

This approach not only allows each partner aim for specific investment outcomes, but also enhances knowledge sharing and exchange of ideas. Blended finance is not a “cure all” that can be exclusively relied upon to drive the needed transformation in global economic systems, but it is an important element in package of available instruments. Broader support for appropriate policy frameworks that can help improve predictability and support low-emission investments are critically important, as are support for institutional strengthening and targeted capacity building in both the private and public sectors.

At the same time, there are many opportunities to expand use of blended finance. To do this will require continued innovation on the ground to help countries and private sector partners match the right types of financial instruments to specific projects goals and objectives.

For the full article:

CLICK HEREThis article is one in a series of opinion pieces on issues covered in the OECD Development Co-operation Report 2016: The Sustainable Development Goals as Business Opportunities.

FULL REPORT